Shopify Bookkeeping Red Flags: Common Mistakes That Could Be Costing You

You’ve been tracking sales, logging expenses, maybe even reconciling here and there—but something still feels off. Your financials might look fine on the surface, but they never quite seem to add up. Sound familiar? In Part 1 of our Shopify Bookkeeping Red Flags series, we’re breaking down the most common general mistakes we see when reviewing Shopify seller’s books. These red flags might seem minor at first, but catching them early can save you from major cleanup (and even bigger headaches) down the road. Ready to learn more? Let’s dive into Shopify Bookkeeping Red Flags: Common Mistakes that could cost you.

Red Flag #1: Old, Unreconciled Bank & Credit Card Accounts

Reconciliation is more than just a bookkeeping buzzword. It’s the process of making sure that what’s recorded in QuickBooks actually matches what happened in real life. Specifically, what cleared your bank or credit card statement.

If you haven’t reconciled your accounts in a while (or ever), there’s no guarantee your books are accurate. The numbers might look right at a glance, but behind the scenes? You could be dealing with duplicate transactions, missing Shopify payouts, or expenses that never made it into your books.

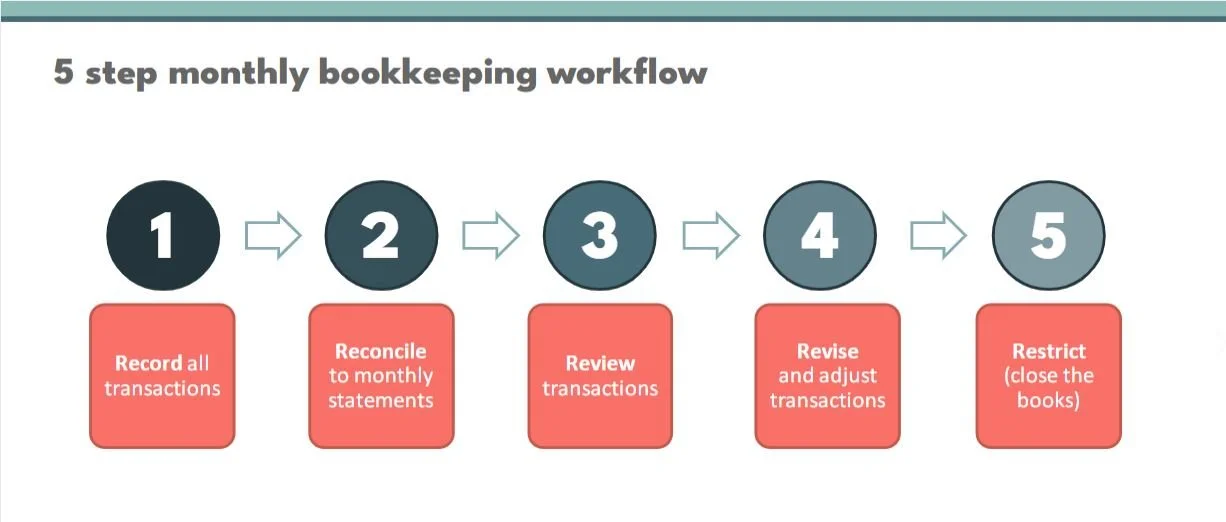

Monthly reconciliations are how you spot quiet errors before they snowball into bigger problems like overstated income, underreported expenses, or incorrect tax filings. Even just a few months of unreconciled accounts can throw your entire financial picture out of whack. That’s why making reconciliation a regular monthly habit is one of the most powerful things you can do to protect your business (Step #2 in the monthly bookkeeping workflow diagram below).

Red Flag #2: Uncleared Transactions Still Sitting in Your Bank Register

Uncleared transactions are ones that haven’t matched up to transactions reflected in your actual bank or credit card accounts. Sometimes they’re manually entered. Sometimes they’re duplicated by a sync or integration. And sometimes… they just don’t belong there at all.

When transactions sit uncleared for too long, it’s a red flag that something has gone wrong. Like a duplicate entry, an accidental manual input, or a payment that never actually went through. If those phantom transactions are still sitting in your books, they’re quietly throwing off your account balances, reports, and even your tax deductions. QuickBooks doesn’t flag these as errors, but you should.

Make it a habit to review uncleared transactions at the end of each month (step #3 in the monthly bookkeeping workflow above). If they haven’t cleared within 30 days, it’s time to investigate. Were they duplicates? Errors? Transactions that never happened? If they’re not real, they don’t belong.

Red Flag #3: Duplicate Transfers or Credit Card Payments

Duplicate transfers and payments inflate your expenses, throw off your cash flow, and make your account balances unreliable. You might think you’ve paid more (or less) than you actually have and that confusion can mess with your decision-making. Especially if you're relying on your books to tell you how much money is really available. For example:

Your credit card liability account might look way off, or you might even show a negative bank balance in QuickBooks when your actual bank account is totally fine. Instead of manually entering both sides of a transfer, let QuickBooks do the matching for you. Record the transaction only in one account (your bank account) and when you see a transaction in your credit card bank feed, use the “Match” feature instead of “Add.” This keeps your records clean and prevents duplication. The goal is always a one-to-one reflection of real activity.

We often see a mess in the PayPal bank account related to duplicating expenses. When expenses are funded through a bank or credit card account, a transfer should be recorded from the bank/credit card account to the PayPal bank account to cover that expense. The actual expense transaction should be recorded to the PayPal bank account only.

When the proper workflow is not followed, you may end up recording the expense directly to the bank or credit card account, and again in the PayPal bank account. Be consistent with recording transfers to/from your PayPal bank account, and ensure that only one expense is recorded (to the PayPal bank account).

Red Flag #4: Duplicated Expenses or Bill Payments

You’re keeping up with your Cost of Goods Sold transactions and other expenses but then your Shopify apps start syncing, too. Suddenly, the same expense gets recorded more than once in QuickBooks. Here’s some examples of how it happens:

You pay $29/month for an app through Shopify. That charge clears your bank account, so it shows up in your bank feed. But at the same time, your app integration—like A2X or another syncing tool—also brings that same charge into QuickBooks. Now that one $29 expense appears two (or even three) times. And QuickBooks doesn’t know it’s a duplicate.

Maybe you have a bill recorded for cost of goods sold - inventory purchases. When the payment clears your bank account, you might record the payment as a new expense, instead of matching it to the existing bill in QuickBooks. Now your books reflects a duplicate for that COGS expense - one from the bill, and a second from recorded the expense directly from the bank register.

These may seem like small duplicates, but they add up fast. It’s crucial to be strategic with your app connections. Know exactly where your expense data is coming from (e.g. bank feeds, PayPal syncs, Shopify integrations, etc.) and make sure you’re not pulling in the same charge from more than one source. Think of it this way: each expense should only enter your books once, from one place.

Red Flag #5: Loans Recorded Incorrectly

We often see a seller take out a loan, the funds hit their bank account and they categorize that net deposit as income. Or, the net deposit for a loan gets categorized to a Loan liability account, but does not account for the total Loan amount received, pre-paid interest expense, or any loan initiation fees.

Sometimes we see books where each monthly payment is logged as an expense or recorded to the Loan liability account without breaking out Principal and Interest. Remember, a loan isn’t income; it’s borrowed money. And your re-payments aren’t a simple business expense or fully recorded against the Loan liability account.

Each loan payment includes two parts:

Principal (the amount that reduces your loan balance)

Interest (the actual expense you can deduct)

If you lump everything into “Loan Payment” or “Business Expense,” you’re overstating your costs, understating your liabilities, and potentially misreporting your taxes. Messy loan records can make your business look riskier than it really is.

When the loan deposit hits your bank account, record it as a liability, not income. From your loan agreement, record the Gross loan amount, and any pre-paid interest expense or fees. Pre-paid interest should be recorded to a new current asset account for pre-paid interest. Then, each time you make a payment, split the transaction between principal (which reduces the loan balance) and interest (which hits your P&L as an expense). Note: If the loan included pre-paid interest, make sure to split a payment transaction between the Principal paid (recorded to the Loan liability account) and the percentage of pre-paid interest paid (recorded to the pre-paid interest Asset account). You’ll then record a Journal entry to capture the pre-paid interest amount as an Interest Expense on your P&L. This reduces the Principal balance in the Loan liability account, increases interest expense captured on the P&L, and reduces the pre-paid interest Asset account.

Your lender should provide an amortization schedule that shows the breakdown for each payment. Use that as your guide—or work with a bookkeeper to help set it up cleanly from the start.

Closing & Resources

That wraps up our top 5 Shopify Bookkeeping Red Flags: Common Mistakes that could cost you. Do you have some of these common Red Flags in your books? Messy books aren’t a sign that you’ve failed—they’re a sign that you’ve been busy building a business. The good news is every single one of these issues is fixable and preventable once you know what to look for. So, start by reviewing your accounts for the common culprits then build a monthly workflow that helps you stay consistent. By catching and correcting these red flags early, you can save yourself a ton of stress (and money) down the road.

Need some more expert guidance? If you are ready to work with a trusted and reliable Shopify bookkeeping team, you can use this link to learn more about Mavency to see if we are a good fit for working together. For some additional support for your DIY Shopify bookkeeping, check out the free and paid resources linked below:

A2X - Sign up to use A2X for your Shopify to QuickBooks Online integration and receive 20% off your first 6 months by using our discount code: A2XMAVENCY

We hope to connect with you soon!