Inventory and COGS Fundamentals for Shopify Sellers

Whether you're just starting out as a Shopify seller or watching your store grow, you've probably heard that tracking inventory and cost of goods sold (COGS) in your bookkeeping is essential. But what exactly are inventory and COGS, and why are they so important for your business? In this article, we’ll break down everything you need to know about Inventory and COGS fundamentals for Shopify Sellers.

What are Inventory & COGS?

Let’s start by defining inventory and COGS from a bookkeeping and accounting perspective.

Inventory includes the goods and products you have ready to sell, along with the materials and components used to create them.

On the other hand, COGS refers to the expenses directly tied to producing the items you've sold. This can include not only the cost of the inventory itself but also payment processing fees, shipping costs, inventory adjustments, and other related expenses.

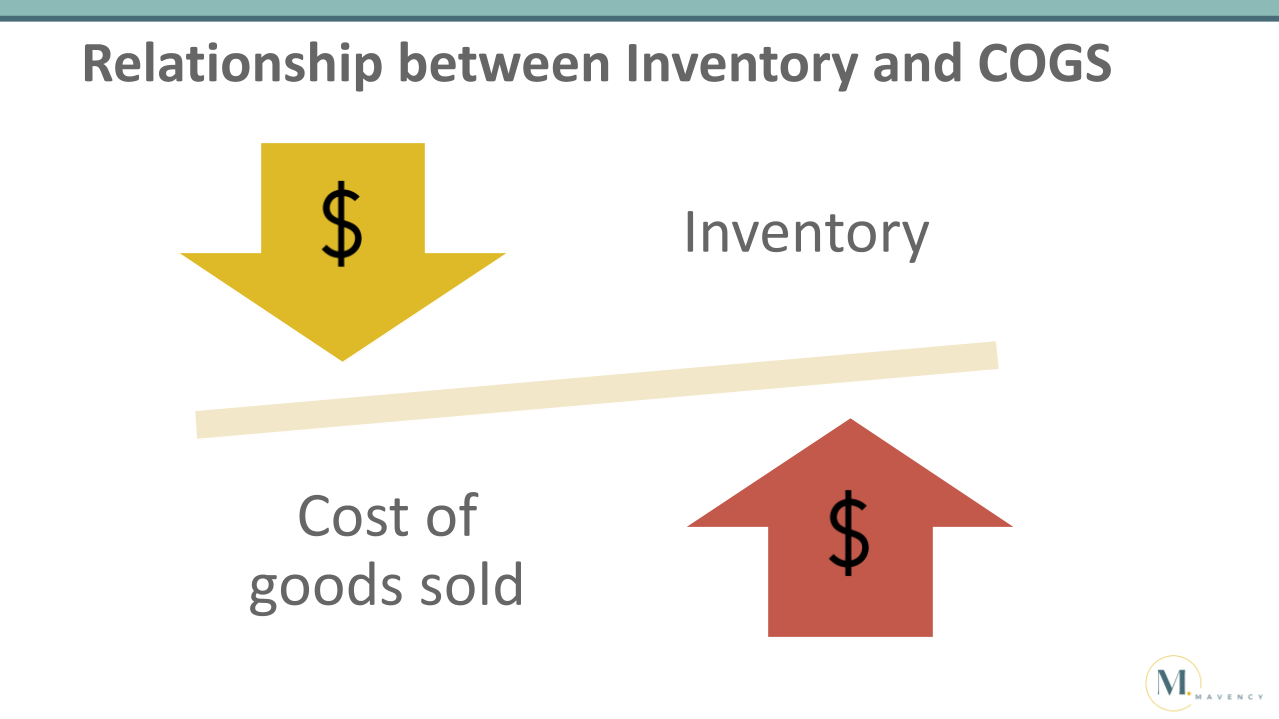

Relationship between Inventory & COGS

There's a clear connection between inventory and COGS, and they often move in opposite directions. When your inventory decreases, it usually means you've sold more products, which causes your COGS to increase. On the flip side, when your inventory increases—perhaps due to purchasing more stock or producing additional goods—your COGS typically decreases. This is because fewer products have been sold. Understanding this relationship is key to keeping your financial records accurate and gaining insight into your store’s performance.

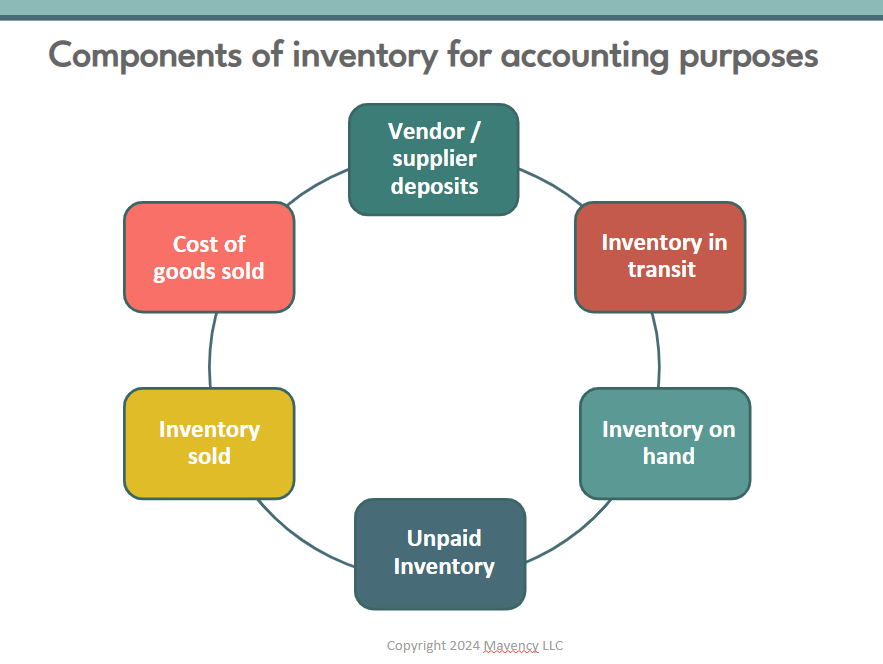

Inventory Accounting & Workflows

There's a lot involved in doing proper inventory accounting. Ideally, you need to be tracking vendor suppliers and deposits, inventory at transit, inventory on hand, unpaid inventory, inventory sold, and of goods sold. Let's go over the flow of inventory and how it affects balances for financial purposes.

A purchase order does not have any effect on your accounting and bookkeeping. Usually, you place a purchase order to purchase inventory, and then pay your vendor in advance. In that case, you're going to increase the balance in vendor advances in your bookkeeping. Later, when inventory is received you'll increase the inventory balance. The balances that were in vendor advances will now move over to inventory and will increase inventory. When you sell inventory, then you will have to decrease your inventory, and then you will also have to reflect cost of goods sold. When we decrease inventory, then we will be increasing cost of goods sold.

Simple Example

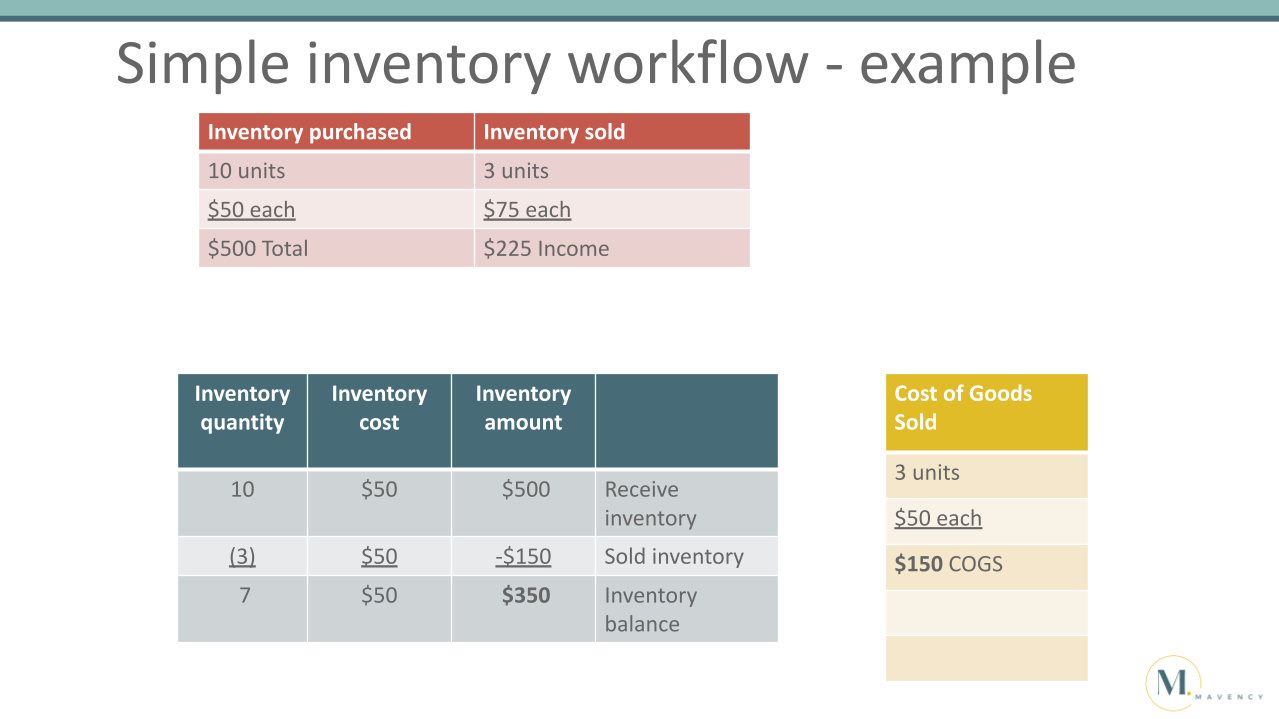

Let’s walk through a simple example from the image below:

Purchasing Inventory

We purchased 10 units of inventory at $50 each.

Total inventory cost: 10 units x $50 = $500.

Selling Inventory

We sold 3 units at $75 each, generating an income of $225.

For inventory purposes, we track the initial purchase of 10 units at a cost of $50 each, which gives us an inventory value of $500 when we received the stock.

Adjusting Inventory

Since we sold 3 units, we reduce the inventory by the cost of those units:

3 units x $50 = $150.This leaves us with 7 units, each still valued at $50, for a remaining inventory balance of $350.

Cost of Goods Sold (COGS)

The 3 units we sold had a total cost of $150 (3 units x $50).This means our cost of goods sold (COGS) reflects an expense of $150.

In summary

Inventory remaining: 7 units valued at $350.

COGS: $150 for the 3 units sold.

Tracking Inventory - Ideal

In an ideal situation—if money were no object—this is how you would manage inventory. Large corporations operate this way, tracking inventory through complex accounting methods. They use formulas for inventory valuation, like LIFO, FIFO, or average cost, and keep tabs on vendor advances, inventory in transit, prepaid inventory, and adjustments for physical or obsolete inventory. On top of that, they layer in inventory operations, tracking SKUs, landed costs, purchase orders, item receipts, supplier invoices, and vendor advances. They also manage fulfillment, reorder points, and much more.

Tracking Inventory - Reality

That’s the ideal scenario. If you had unlimited time, money, and resources. But for most e-commerce sellers, especially those just starting out, the reality is quite different. You don’t have the luxury of perfect inventory tracking. Instead, it’s about what’s practical for you based on your available time, resources, and the size of your business.

Find the Right Fit

You need to find the right approach based on your business stage, goals, and capabilities. Consider where you are in your journey: Are you a new seller? Is your business growing? Or are you already well-established? What are your goals? Do you want to stay compliant with tax regulations, or are you aiming for better insight into your profits?

Next, think about your resources—your time, tools, and team. Do you have the capacity to track inventory regularly, or are you relying on basic methods like spreadsheets or Shopify’s built-in tools? Are your processes and systems organized, and do you have the funds to invest in software or personnel to manage inventory efficiently?

For new or smaller sellers, it may make sense to adjust inventory only once a year. This basic method is a good fit when time and resources are limited, and your main priority is staying compliant with tax rules. However, if your business is growing and profitable, you might consider tracking inventory monthly. This offers more detailed insights into your profits. This would likely require an inventory management app, along with the time, resources, and systems to support it.

Ultimately, it's about finding balance. Where should you focus your time? Should you prioritize growing your store, increasing sales, and promoting your brand? Or should you invest in the accuracy of your inventory tracking? While accountants love precision, you have to consider what makes sense for your business. Accurate numbers help with tax compliance, provide clearer visibility into profits, and ensure you’re staying on track financially. But remember, it’s all about aligning your efforts with the current stage of your business.

Get Started with Tracking Inventory

If you're just starting out and feeling unsure about how to begin tracking inventory and COGS, here's a simple trajectory to follow. First, focus on determining your landed costs—this is the total cost to get your products ready for sale, including shipping, taxes, and any other fees. Once you have that figured out, start by tracking your inventory using a basic spreadsheet or Shopify's inventory feature. Keep in mind, while Shopify inventory can help, it's not a full inventory management system.

As your business grows, your goal should be to transition to inventory management software. This will streamline your operations and provide the detailed reporting you need to properly track both inventory and COGS for accounting purposes. The right tools will not only make tracking easier but also give you better insights into your business performance.

Closing & Resources

Inventory and COGS Fundamentals for Shopify Sellers highlights that while inventory management can be complex, it’s crucial to choose an approach that fits your business stage and resources. The key is finding the balance that works for you with a system that will support compliance and profit visibility.

Need some more expert guidance? If you are ready to work with a trusted and reliable Shopify bookkeeping team, you can use this link to learn more about Mavency to see if we are a good fit for working together. For some additional support for your DIY Shopify bookkeeping, check out the free and paid resources linked below:

A2X - Sign up to use A2X for your Shopify to QuickBooks Online integration and receive 20% off your first 6 months by using our discount code: A2XMAVENCY

We hope to connect with you soon!