How to reconcile e-commerce clearing accounts in QuickBooks Online

Shopify sellers often juggle many financial management tasks, including managing e-commerce clearing accounts. But what are payment clearing accounts, and how can you maintain them accurately in your records each month? Keep reading to discover how to reconcile e-commerce clearing accounts in QuickBooks Online!

What are e-commerce clearing accounts?

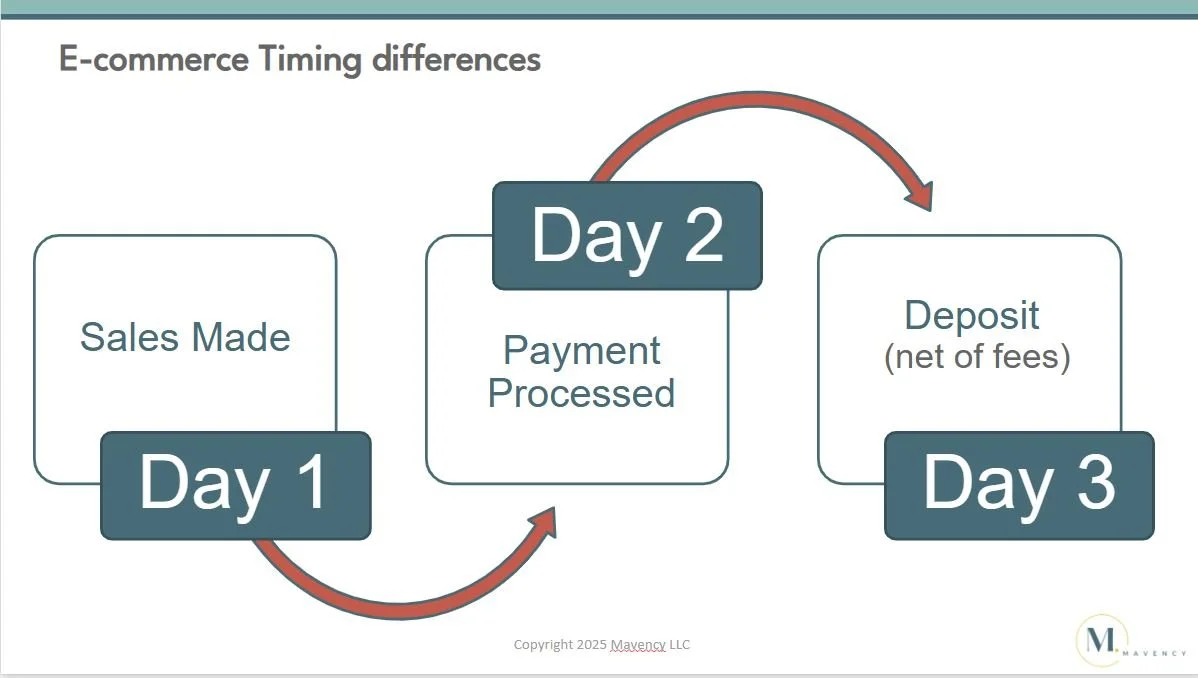

E-commerce clearing accounts represent the timing differences between when sales are made and when payments are received from the payment processor. Clearing account balances are like accounts receivable from each payment processor.

Clearing account workflow

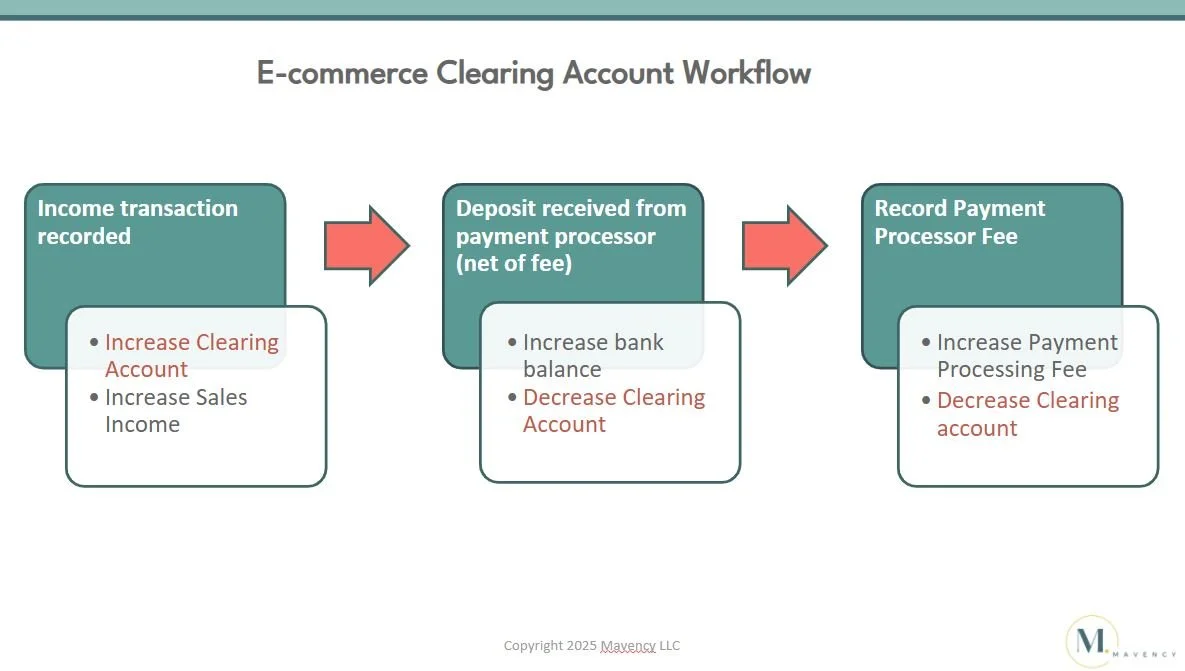

To understand the clearing account workflow, consider the following:

Sales make the e-commerce clearing account balance go up.

Deposits from the payment processor make the balance go down.

Recording payment processor fees also lowers the balance.

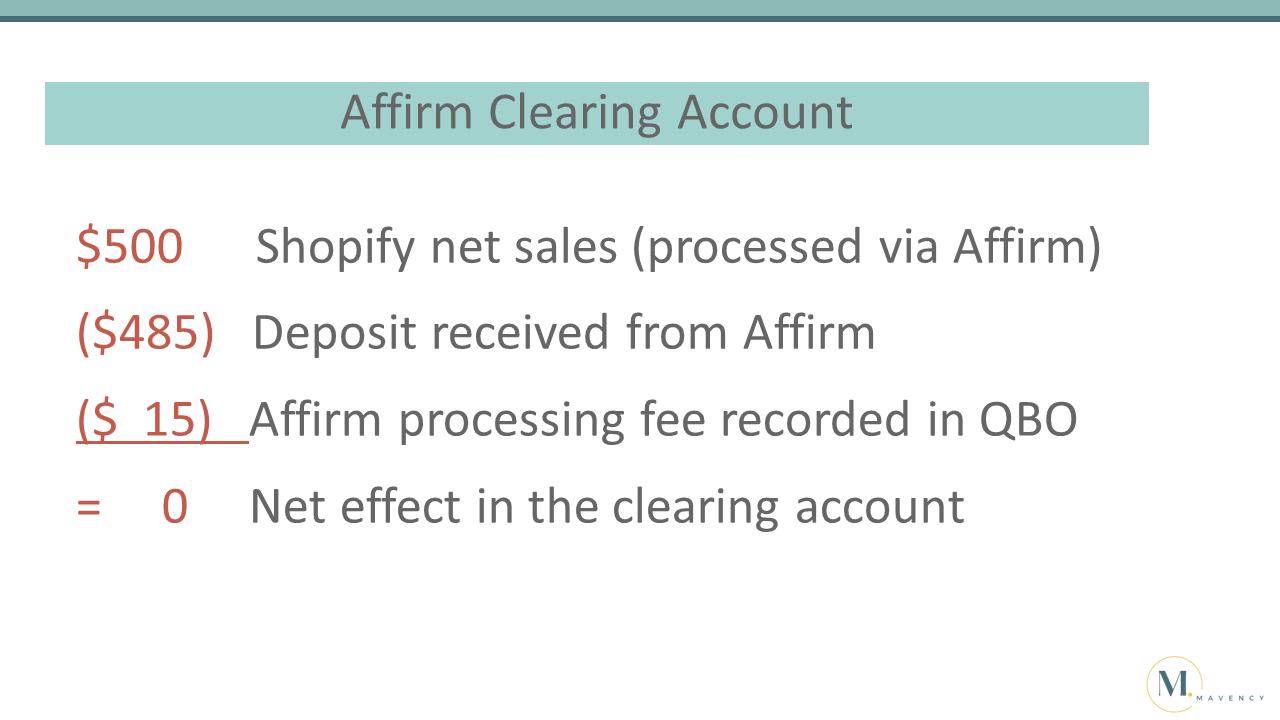

Let’s go over an example:

In this example, we have $500 of net sales from Shopify processed using Affirm as the payment processor. A couple of days later, a $485 deposit is received from Affirm and the $15 fee is recorded in QuickBooks. The net effect of these transactions in the firm clearing account is zero.

Setting up chart of accounts

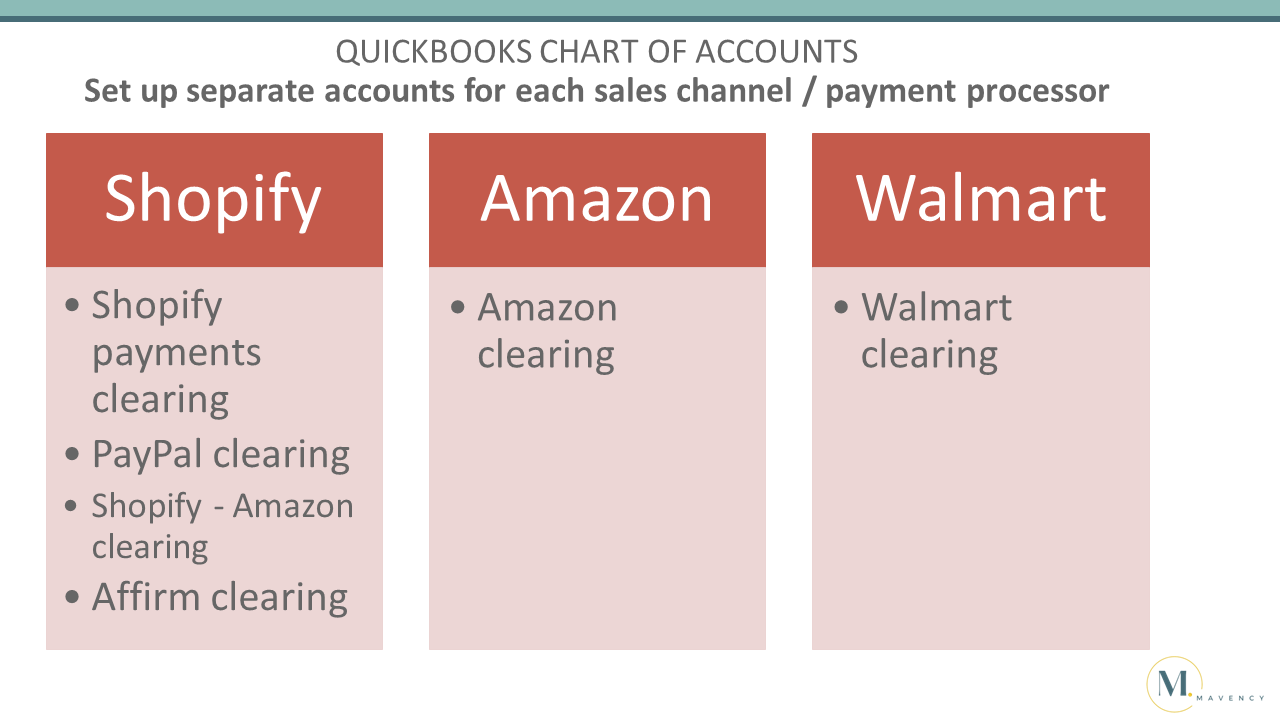

To manage and reconcile clearing accounts correctly, it’s crucial to set up separate account categories in QuickBooks Online for each sales channel and payment processor.

A good example of clearing accounts for different sales channels can be seen here:

After all sales, deposits from payment processors, and payment processing fees are recorded for the month then you'll start the reconciliation process. Step one includes reconciling sales between Shopify and QuickBooks Online. Step two includes reconciling all e-commerce clearing accounts.

How to reconcile Shopify Payments

Let’s dive deeper into Shopify payment reconciliations:

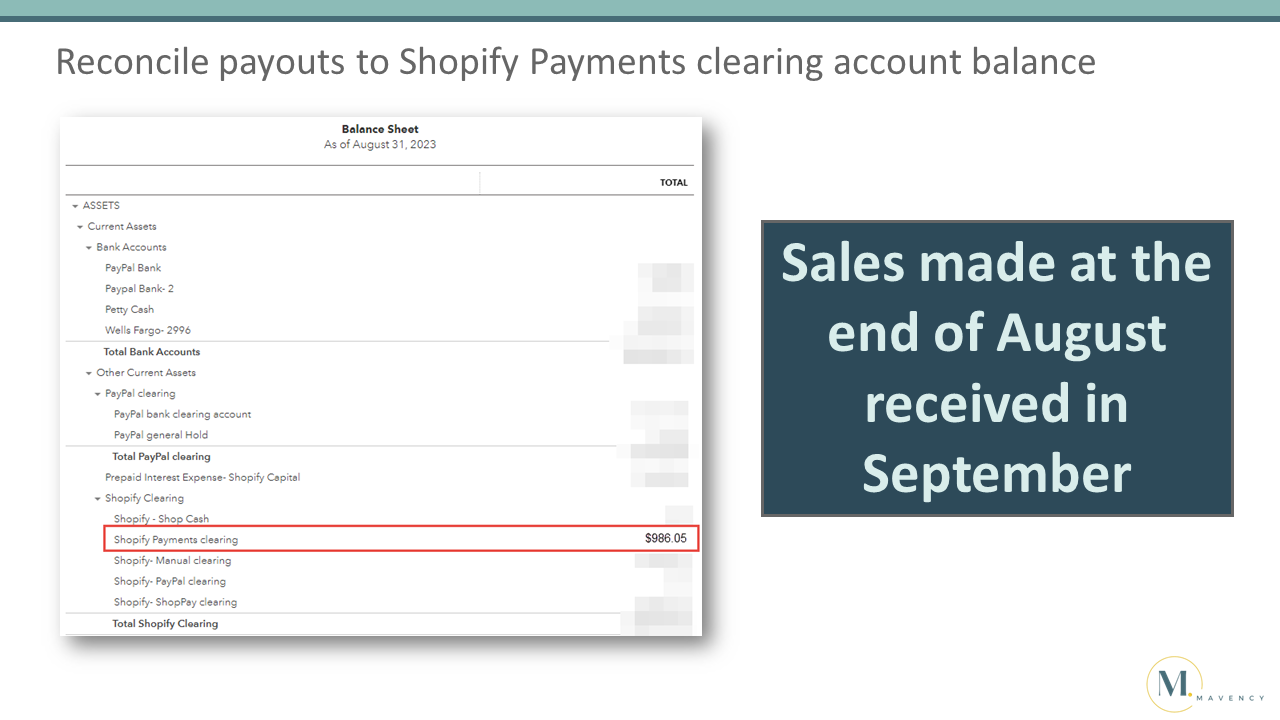

The balance in the Shopify Payments Clearing account as of August 31st is $986.05. This represents sales made at the end of the month of August that were received in September.

To find the payouts made in September for sales made in August in Shopify, go to finances then select payouts.

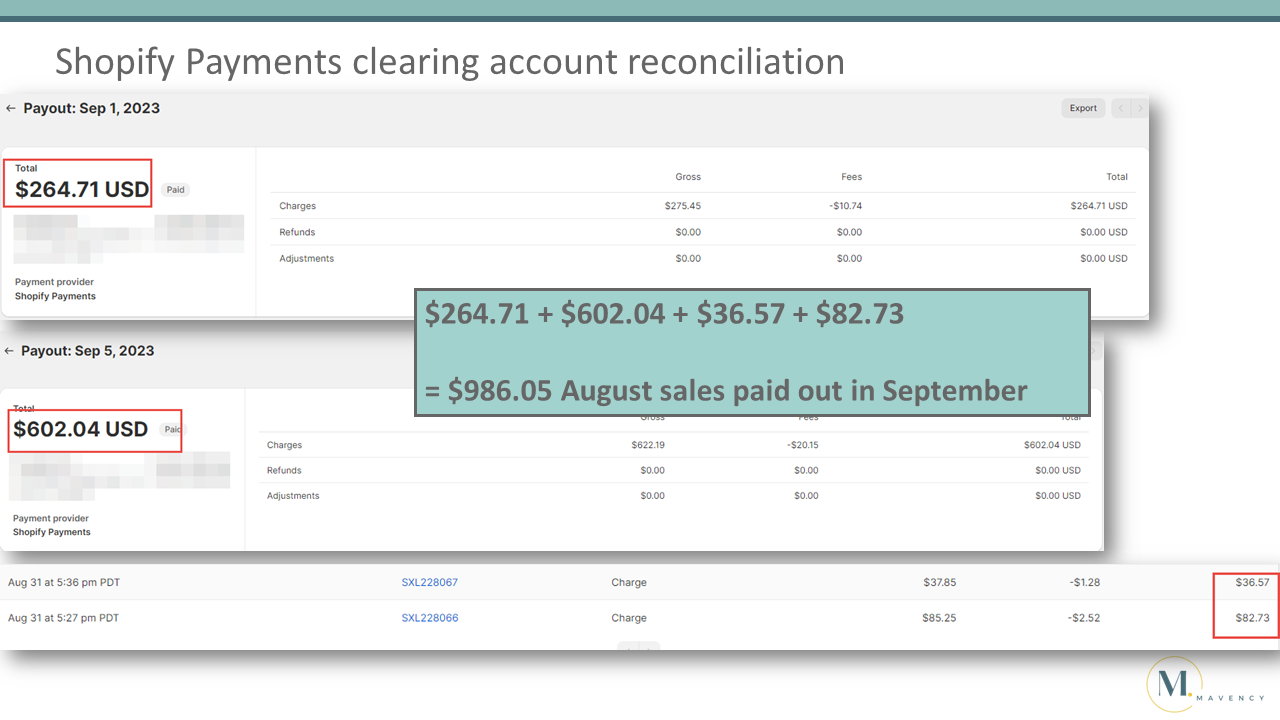

When opening the payout for September 1st, you will see all sales transactions are from August. There will be the payout amount, gross sales, fee, and the net amount paid out. Be sure to make a note of the payout amount.

Go back to the payouts and the payout for September 5th. Again, all of the sales transactions were for August. Make a note of this payment amount.

Go back to the payouts and open the payout for September 6th. There are several transactions for September, but still two transactions for August. You'll notice several transactions for September, but there are two transactions for August. Make a note of the net amount paid out for the August transactions.

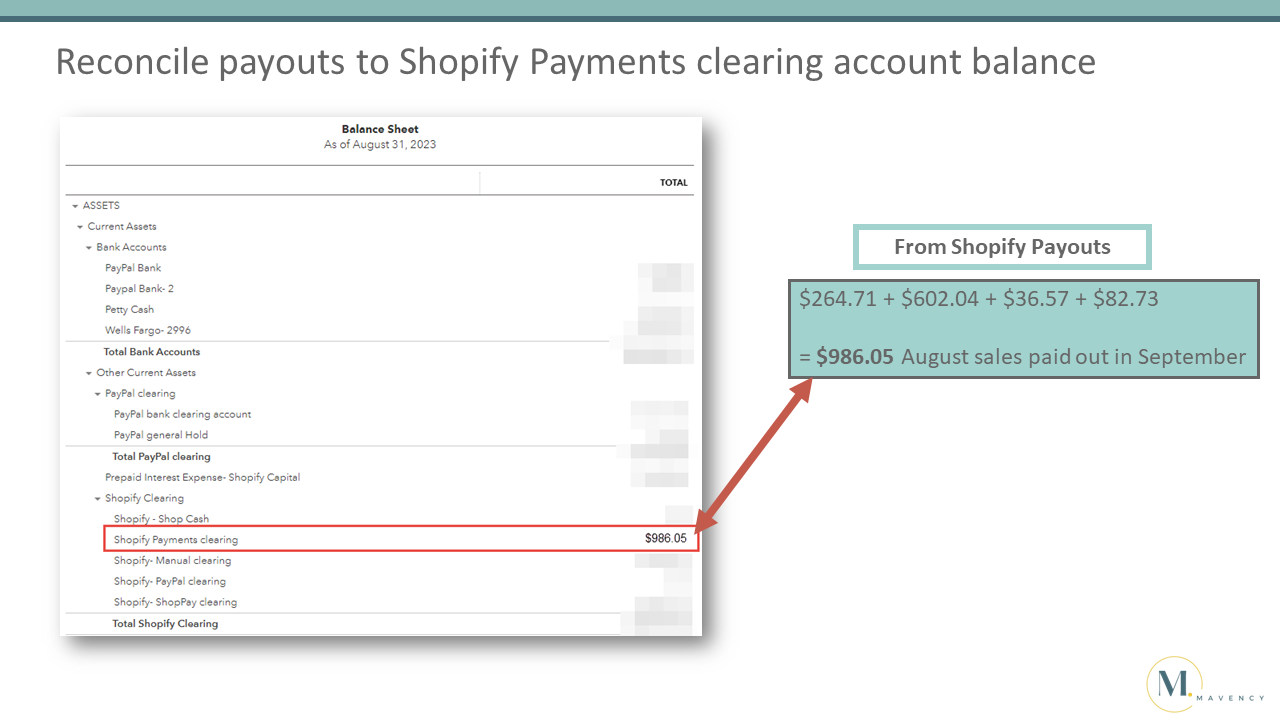

This screenshot shows the amounts paid out in September for sales made in August. The total is $986.05.

The balance of the Shopify Payments Clearing Account in QuickBooks as of August 31st is $986.05. The total of the payouts made in September for August sales was for $986.05. Since the amounts the clearing account is reconciled.

How to reconcile other payment processors

Keep in mind that each payment processor is different and may have its own requirements and reports.

For this example, let’s focus on reconciling the Stripe clearing account.

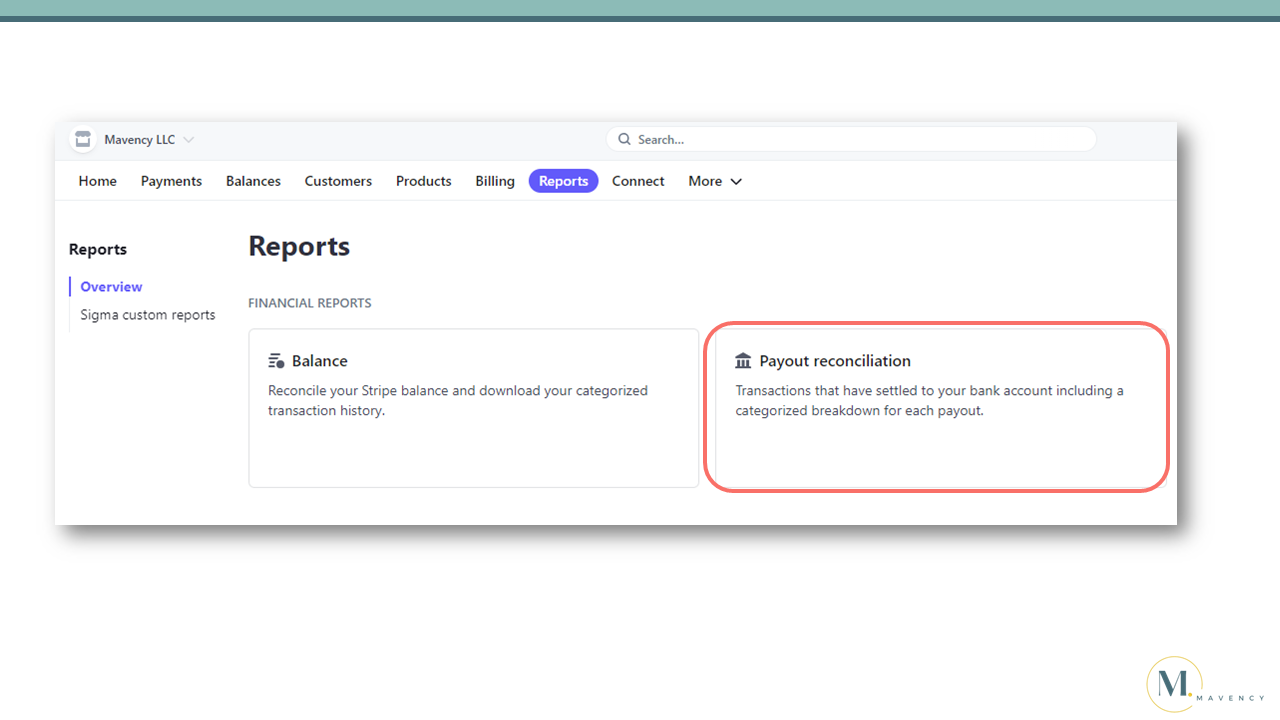

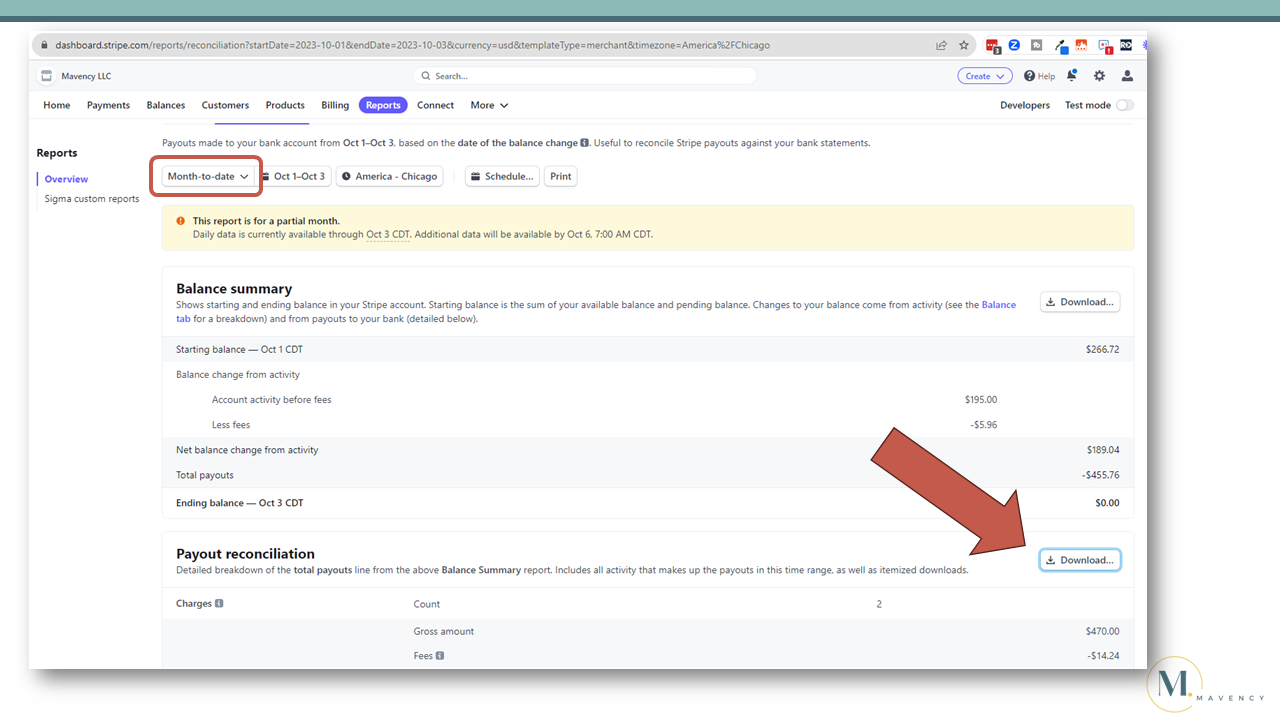

In Stripe, select Reports and Payout Reconciliation.

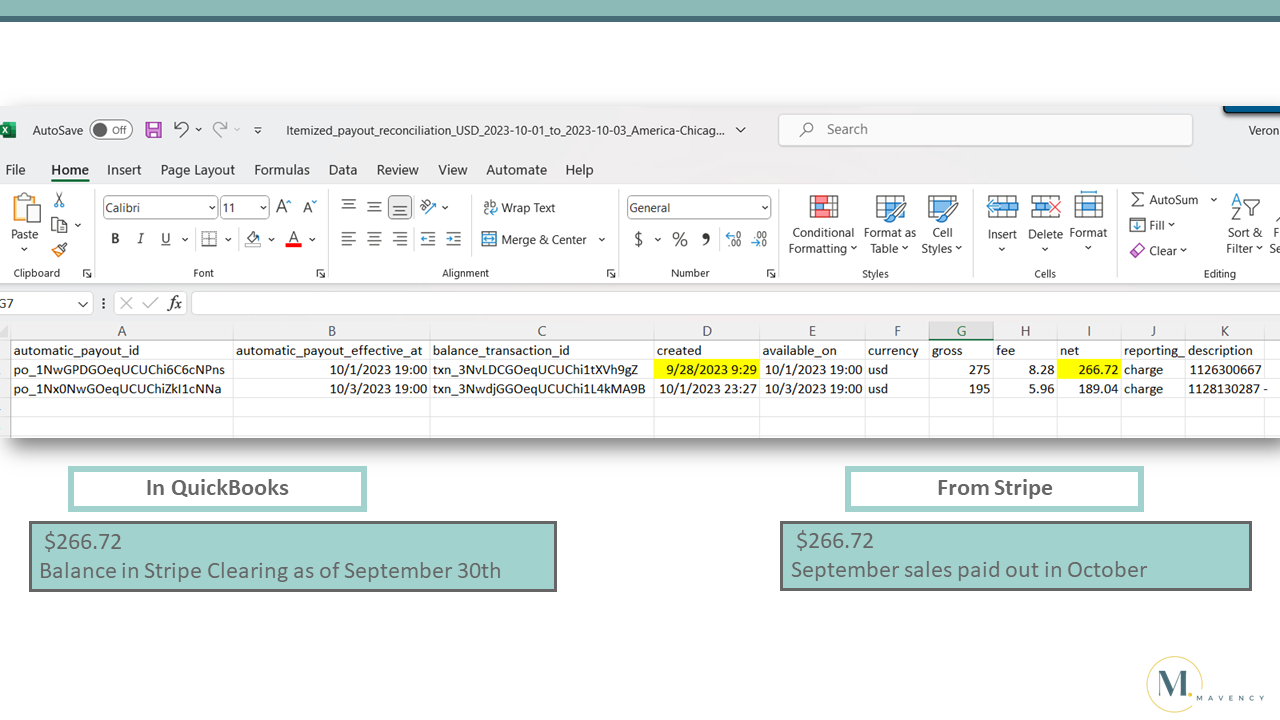

Select the appropriate date. In this case, we will use the month-to-date report to view payouts for sales made in the prior month. Scroll down to download the payout reconciliation.

Open the spreadsheet and look for the sales made in the prior month. The date will be under the created column and the amount under the net column. The balance in the Stripe Clearing account as of September 30th is $266.72. The amount paid out by Stripe on October 1st is also $266.72. That means that the Stripe Clearing account is reconciled.

FAQ: Should balances in the clearing account zero out each month?

No, e-commerce clearing account balances will not zero out every month because of the timing differences between when sales are made and when payouts are received.

Closing and Resources

Now that we’ve explained how to reconcile e-commerce clearing accounts in QuickBooks Online, it’s important to note that reconciling the clearing accounts for each payment processor is a crucial step that must be completed monthly. For some additional support for your DIY Shopify bookkeeping, check out our free and paid resources linked below:

A2X - Sign up to use A2X for your Shopify to QuickBooks Online integration and receive 20% off your first 6 months by using our discount code: A2XMAVENCY

Interested in even more expert guidance on Shopify bookkeeping? If you are ready to work with a trusted and reliable Shopify bookkeeping team, you can use this link to learn more about Mavency to see if we are a good fit for working together.

We hope to connect with you soon!